Mortgage Blog

Let us make this easy for you!

Weekly Update October 13th 2023

October 13, 2023 | Posted by: Paul London

Real Estate News in Brief

It was another rough week for the housing market, with September inflation (CPI & PPI) coming in higher than expectations, and homebuyer sentiment bumping along the bottom. But more Fed members seem inclined to stop further rate hikes, causing mortgage rates to ease slightly.

Dear Mr. Powell, won’t you help us please? The NAR, NAHB & MBA jointly penned a plea to the Fed Chairman. To paraphrase: you are killing the housing market with high interest rates, please: 1) make it official that you’re done raising rates, and 2) lay off the quantitative tightening.

Has the market finished the Fed’s job? Several Fed officials (including Vice Chairman Philip Jefferson) suggested that the market-driven rise in longer-term bond yields was a form of tightening that could eliminate the need for further rate hikes.

A bad time for buyers. Fannie Mae’s Home Purchase Sentiment Index for September saw the % of respondents saying that it was a “Good Time to Buy” drop to just 16%, the lowest level in 2023, and tied with lowest level in 2022. However, 63% thought it was a “Good Time to Sell.” [Fannie Mae]

The headline PPI figure (Producer Price Index = inflation for businesses) for September rose 0.5% MoM, a good deal higher than expectations. On a YoY basis, headline PPI inflation was up 2.2%, much higher than the +0.2% YoY reported in June. Core PPI was less of a surprise, up 0.3% MoM, versus expectations of 0.2%. [BLS]

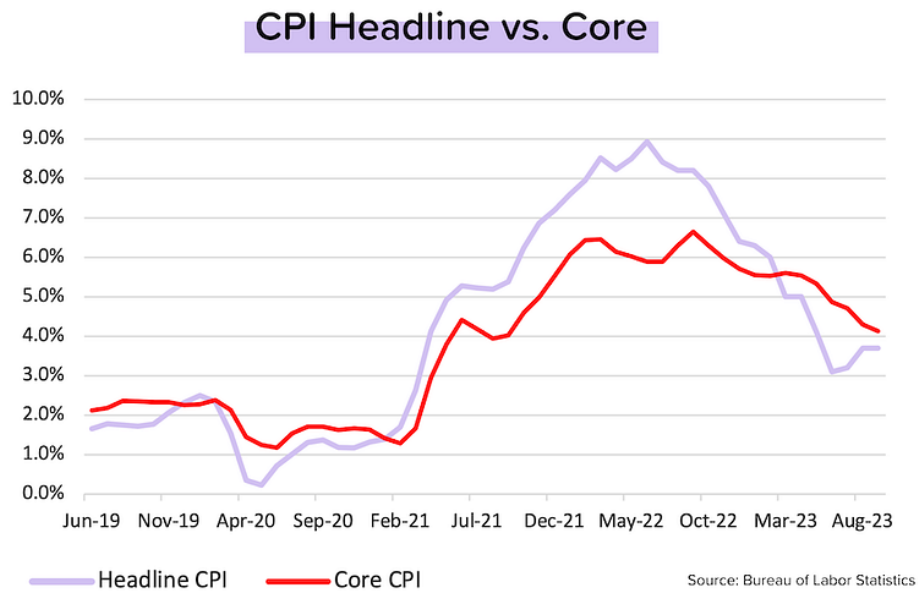

The headline CPI figure (Consumer Price Index = inflation for us) for September rose 0.4% MoM, also higher than expectations. On a YoY basis, headline CPI was flat at +3.7%, while core CPI (which excludes fuel & food prices) continued its steady descent, dropping from +4.3% YoY in August to +4.1% YoY in September. [BLS]

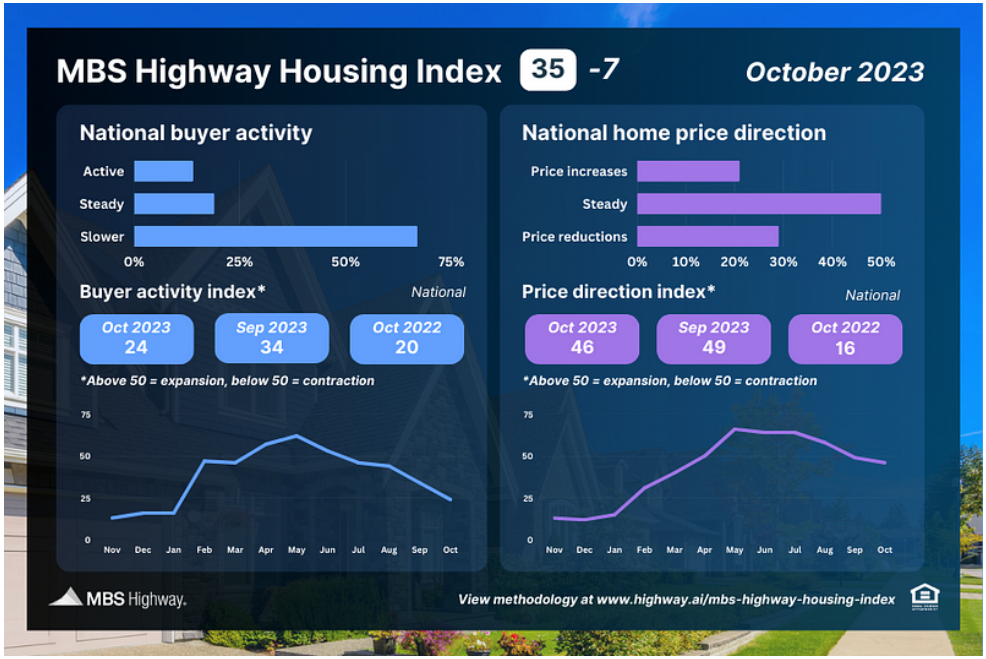

The MBS Highway National Housing Index fell to 35 in October 2023 from 42 in September 2023. In October 2022, the index was at 18. Buyer activity continued to slow as average 30-year mortgage rates climbed above 7.5%. But home prices are still rising or holding up in most markets. [MBS Highway]

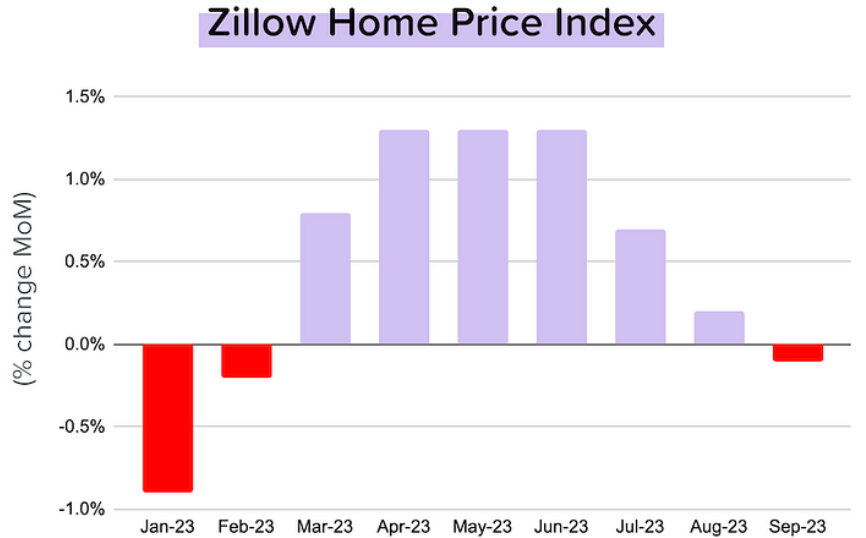

A double-dip in home prices? One datapoint does not a downturn make, but it was intriguing to see Zillow’s Home Value Index DROP 0.1% MoM in September, the first MoM decrease since February 2023. Has the relentless rise in mortgage rates finally hit demand enough to counteract the buttressing effect of low inventory levels? [Zillow]

Dear Mr. Powell, won’t you help us please?

It’s not unusual for the National Association of Realtors, the National Association of Home Builders and the Mortgage Bankers Association to lobby together. But I thought the letter that they jointly sent Jerome Powell on October 9 was unusually aggressive. I’ve cut out a few sections and added my thoughts:

We want to “convey profound concern shared among our collective memberships that ongoing market uncertainty about the Fed’s rate path is contributing to recent interest rate hikes and volatility. This has exacerbated housing affordability and created additional disruptions for a real estate market that is already straining to adjust to a dramatic pullback in both mortgage origination and home sale volume. These market challenges occur amidst a historic shortage of attainable housing.”

[SBB]: They’ve certainly got a point. Affordability has been crushed by the rise in mortgage rates AND home prices. But I didn’t hear any of these people complaining when rates were in the 3s and the gold rush was on!

“We strongly urge the Fed to make two clear statements to the market:

- The Fed does not contemplate further rate hikes

- The Fed will not sell off any of its MBS holdings until and unless the housing finance market has stabilized and mortgage-to-Treasury spreads have normalized.”

[SBB]: In other words, stop playing around and just tell the market that the rate hike cycle is over. The second bullet point refers to quantitative tightening. If the Fed begins to reduce its balance sheet (selling mortgage-backed securities), it can push the price of MBS down (which lifts their yield and can lead to higher mortgage rates).

“Housing activity accounts for nearly 16% of GDP according to NAHB estimates. We urge the Fed to take these simple steps to ensure that this sector does not precipitate the hard landing the Fed has tried so hard to avoid.”

[SBB]: Wow! Aggro! That said, there is nothing wrong with the NAHB’s statement: housing (in the broadest sense) is very important to the US economy, and it is often housing that leads the economy into recession.

New MBS Highway Housing Survey

We’ve made a number of changes to make the MBS Highway Housing Survey faster to take, and the results easier to understand. In short, we transformed all the survey responses into index levels that range between 0–100, with anything above 50 being positive/expansionary. Oh, and we made the infographics a lot nicer to look at.

National Data

Our National Housing Index (top of the image below) dropped from 42 in September 2023 to 35 in October 2023. A year ago — when home prices and transaction volumes were falling across the board — the index was at 18.

Buyer activity continued to slow as average 30-year mortgage rates climbed above 7.5%. The National Buyer Activity sub-index (left side of the image below) dropped to 24 in October 2023 from 34 in September 2023, but remained slightly above the 20 seen in October 2022.

Reflecting strong competition for limited inventory, the National Home Price Direction sub-index (right side of the image below) held up much better, easing to 46 in October 2023 from 49 in September 2023. One year ago, the sub-index was at 16.

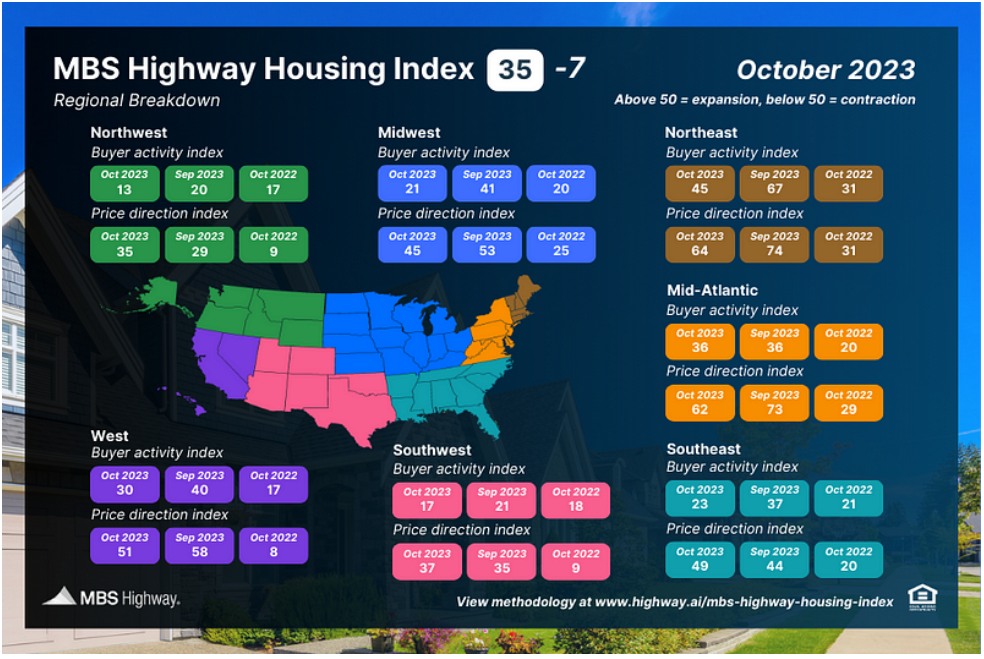

Regional Data

Every region saw a significant slowdown in October 2023 relative to September 2023. In the Northwest and Southwest regions, the Buyer Activity index has now slipped below last year’s levels, a clear indication of how quickly things have cooled.

The Northeast and Mid-Atlantic remain the busiest regions, and (together with the West), are the only areas where price direction remains net positive. The recovery in the West region has been remarkable. A year ago, it had the lowest buyer activity and the most negative price direction. Today, it is the 3rd-most active region, with the 3rd-best price direction.

Mortgage Market

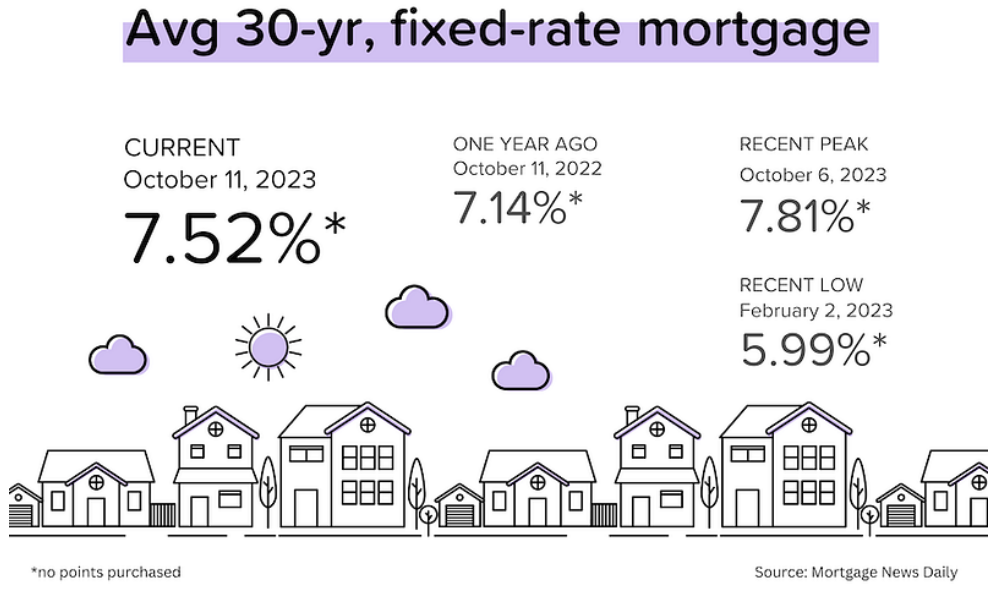

September was ugly for the bond market and mortgage rates, with new highs hit almost every week. On October 6, the average 30-yr mortgage rate hit 7.81%, levels not seen since 2000.

The good news (not much of that recently!) is that rates have eased off this week, mainly thanks to public comments from various Federal Reserve officials suggesting that they’ve already done enough to tame inflation.

- “We’re finally getting very good inflation data. If this continues, we’re pretty much back to our target” — Christopher Waller, Fed Governor

- “I actually don’t think we need to increase rates anymore.” Policy is “sufficiently restrictive.” — Raphael Bostic, Atlanta Fed President

- “If long-term interest rates remain elevated…there may be less need to raise the Fed Funds Rate.” — Lorie Logan, Dallas Fed President

-

They Said It

“Mortgage rates persistently over 7 percent appear to be deepening the malaise consumers feel about the home purchase market,” said Doug Duncan, Fannie Mae Senior Vice President and Chief Economist. “In fact, high mortgage rates surpassed high home prices as the top reason why consumers think it’s a bad time to buy a home, a survey first.” — Doug Duncan, Fannie Mae’s Chief Economist.

Goodbye Paperwork.

Goodbye Paperwork.

Hello Quick Approval.

Save Your Time & Apply Online. Guaranteed Lowest Rates!